Updates

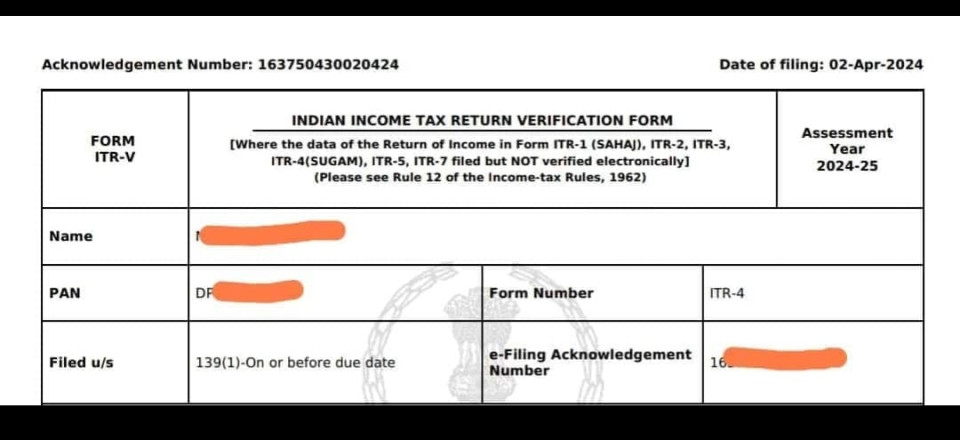

Breaking News: Income Tax Online Filing for Assessment Year 2024-25 Now Open

Great news for taxpayers! The Income Tax Department has opened up online filing, but for now, it's only for Forms 1 to 4. These forms are for different types of taxpayers like individuals and families.Here's what you need to know for hassle-free filing.Who Can Use It: If you're an individual or part

UTLISATION OF INPUT TAX CREDIT

RULE 1: Credit can be utilized to pay off the liabilities in the following manner:(a) IGST input tax credit shall first be utilized towards payment of IGST liability and the amount remaining, if any, may be utilized towards the payment of CGST, SGST/UTGST liabilities in any order, before utilizi

IMPORTANT DUE DATES OF INCOME TAX RETURN (ITR)

Income Tax Return due dates for FY 2022-23 (AY 2023-24)The table below outlines the deadlines for filing ITR in 2023Taxpayer CategoryITR filing Due Date for FY 2022-23Due date to file audit report for FY 2022-23Businesses (Audit cases including Private Limited Companies, OPC, LLPs, and firms)31st Oc

Important filing dates on GST portal

Important dates GSTR-3B (Nov, 2023) Dec 20th, 2023 GSTR-3B (Oct-Dec, 2023) Jan 22nd, 24th, 2024 GSTR-1 (Nov, 2023) Dec 11th, 2023 GSTR-1 (Oct-Dec, 2023) Jan 13th, 2024

ITAT Upholds Income Tax Addition On Amount Received For Arbitration Settlement

The Delhi bench of Income Tax Appellate Tribunal (ITAT) has recently upheld the addition made by the assessing officer upon the income received on arbitration settlement. Assessee TGE Gas Engineering was incorporated in Germany and is a tax resident therein. The assessee had a Project office in Indi