Call back request

Updates

Breaking News: Income Tax Online Filing for Assessment Year 2024-25 Now Open

Great news for taxpayers! The Income Tax Department has opened up online filing, but for now, it's only for Forms 1 to 4. These forms are for different types of taxpayers like individuals and families

UTLISATION OF INPUT TAX CREDIT

RULE 1: Credit can be utilized to pay off the liabilities in the following manner:(a) IGST input tax credit shall first be utilized towards payment of IGST liability and the amount remaining, if an

Income Tax

Income tax is a tax charged on the annual income earned by an individual. The amount of tax paid will depend on how much money you earn as income over a financial year. One can proceed with Income tax payment, TDS/TCS payment, and Non-TDS/TCS payments online. All taxpayers must fill in the relevant details to make these payments. The entire process becomes simple and quick.

Submit Now

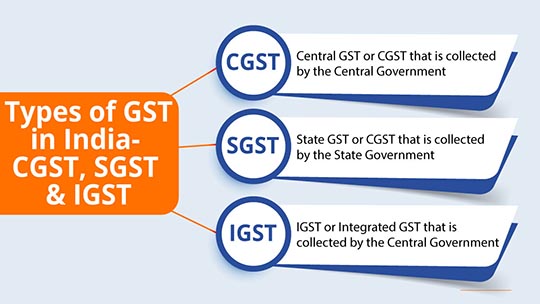

Goods and Services Tax(GST)

A GST Returns is a document that contains information about the income that a taxpayer must file with the authorities. This information used to compute the taxpayer's tax liability. Under the Goods and Services Tax, registered dealers must file their GST returns with details regarding their purchases, sales, input tax credit, and output GST.

Submit NowRecent Blog

-

How to Get Maximum Income Tax Refund in 2025 Under the New Tax Regime

How to Get Maximum Income Tax Refund in 2025 Under the New Tax Regime

-

Understanding Taxation: A Simple Guide